Do you have an emergency fund ?

If you don’t have a medical emergency fund then you need to buy a health insurance today itself.

You can ONLY buy a good policy when you are fit and healthy. Lets try to understand important concepts of Health Insurance, incase you get confused; do ping me on 9544836262.

Waiting Periods

Most of the insurance plans will have the three waiting periods:

1. Initial; 30 Day Waiting Period

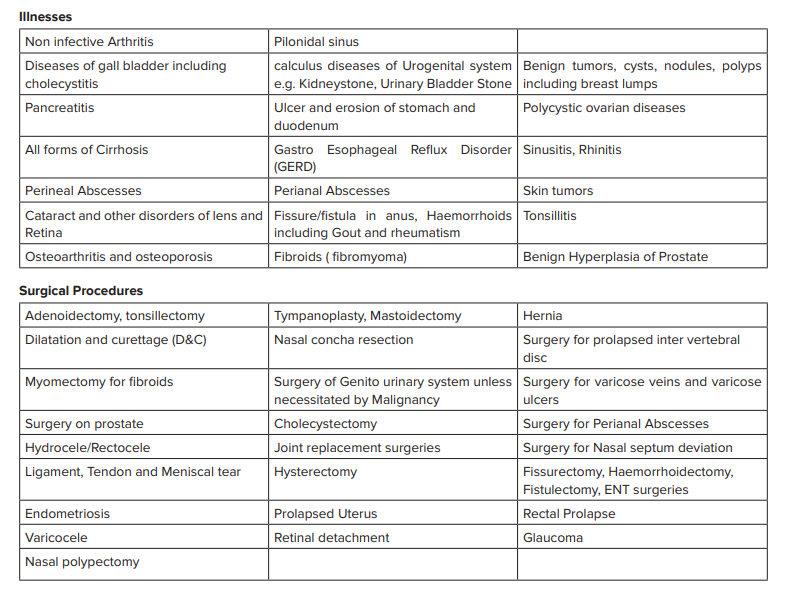

2. Two Year waiting for slow growing illness like cataract, Ulcer etc; See the below snapshot

3. Three year waiting period for all the illness that we have before buying the policy, if you are diagnosed with critical illness related to brain or heart, getting a good plan will be difficult. Waiting for certain lifestyle diseases like Diabetes, High Blood Pressure, Cholesterol etc can be reduced by paying extra for riders.

Permanent Exclusion

Most of the insurers don’t cover Maternity Costs, OPD Expenses, Fertility Treatments, Weight Loss Procedures Etc. Search for Standard Exclusions in the Policy Wordings for the complete list.

Premiums

- Premiums will increase every year depending upon the plan that you chose; you can expect 4-5% increase.

If you plan has age brackets like 15 to 25, 26-30 etc, then you can expect an increase of 15-20% - Your premiums will increase if the inflation is higher; this normally happens once in 2-3 years.

- If you have any medical condition or illness while buying the policy, premiums can be increased in the range of 10-40% depending on the company you chose. These are called LOADING CHARGES.

Room Rent Limits

Never select any plan that has Room Rent Limits.

A room limit will stop you from getting better facilities or rooms in the hospital and the insurance company can reject your claim up to 50-60% due to PROPORTIONATE DEDUCTION policy. Let check out an example.

Example, if You have opted a room rent limit of ₹1,500 per day but You go in for a room with a rent of ₹3000 per day which is three times the allowed limit, when You claim, We will pay one-third of the Total bill amount and deduct the balance i.e. in the same proportion as it increased. This is because the other charges related to Your treatment like Doctor’s fees, also increase with the room type. This deduction will not be applicable for the cost of medicines and consumables.

Disease Limits

Avoid all plans plans that have limits on treatments like:

50,000 for Cataract

1 Lac for Knee Replacement

2.5 Lacs for Cancer Etc

Medical costs will increase every year, you must not get restricted and get the full benefits of the premiums you pay.

Bonus or No Claim Bonus

A good plan will have a great bonus structure; for example 50% of base cover as bonus in second and third year even if you make a claim. The bonus shouldn’t have any conditions or linked to CLAIMS.

Most of the new age plans will give you bonus even if you claim. A good bonus structure will help you to cover medical costs for the next 5-10 years.

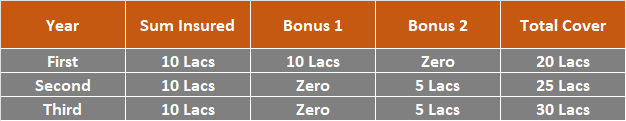

Lets see an example of bonus structure in a plan called Optima Secure from HDFC Ergo.

Restoration – Refill- Reset

Always purchase plans that have unlimited restoration or reset feature and avoid plans with COMPLETE RESTORATION or DIFFERENT ILLNESS clause. If you want to know more about restoration, feel free to ping me at 9544836262.

Restoration is always done only on the base cover.

Let me explain you restoration with an example: Lets assume Mr. Rahul has a sum insured of 10 Lacs and he uses 7 lacs in a hospitalization, so technically for the next hospitalization only 3 lacs would be left. Now if your plan has RESTORATION feature, for the next hospitalization, you will have 10 lacs available instead of 3 Lacs. This feature is especially beneficial for a family floater plan.

So these were some some of the basic features that you should know while purchasing a plan, below information is good to know !

Co Payment

Avoid all plans that have co payment as much as possible if you are below 60; Co payment means that you will share a 10% or 20% of the final hospital bill.

Consumables

The cost of medical supplies such as syringes, gloves, bandages … are not covered in the health insurance plans, its a great addition if your plan covers consumables. This typically ranges between 5-10% of the final medical bill.

Life Long Renewal

You should be able to renew your health insurance for lifelong, some of the plans from various platforms and banks are group health insurance.

The premiums may look attractive in group plans but features can change or plans can be withdrawn at short notice . Always ask for a retail health insurance plan.

Pre Post Hospitalization

Usually health plans have benefits of 60 days pre and 180 post hospitalization. All the expenses leading to the admission and post discharge procedures related to the same illness will be covered under PRE-POST hospitalization.

You can only claim incase of admission deemed necessary, if you get admitted to hospital as a precaution, the expenses will not be covered.

Incase of planned treatments; always get pre authorization from the insurance company.

Day Care Procedures

Most of the health insurers cover day care treatments, for example cataract, dialysis, chemotherapy.

Check if there is any approved list for day care treatments, your plan should cover all day care treatments and not a restricted list.

Reasonable & Customary Clause

Insurance companies follows a policy to check the STANDARD cost of treatments in a particular geographical area, if the insurer feels that the cost of treatments are inflated or unnecessary, Only a part of the claim amount may be paid. There are doctors who work in the insurers team that approves the claim.

Claim Rejections

Claims are mainly rejected due to the below reasons:

Hiding existing diseases or hospitalization

Claims during waiting periods

Insufficient information or documentation

When the treatment is not necessary

Claims related to evaluation only and no active treatment

Unreasonable costs & bills

Thank you for taking time to read !! more topics will be added in the future and in case you have any specific question about Term Insurance or Health Insurance, Call us on 9544836262.